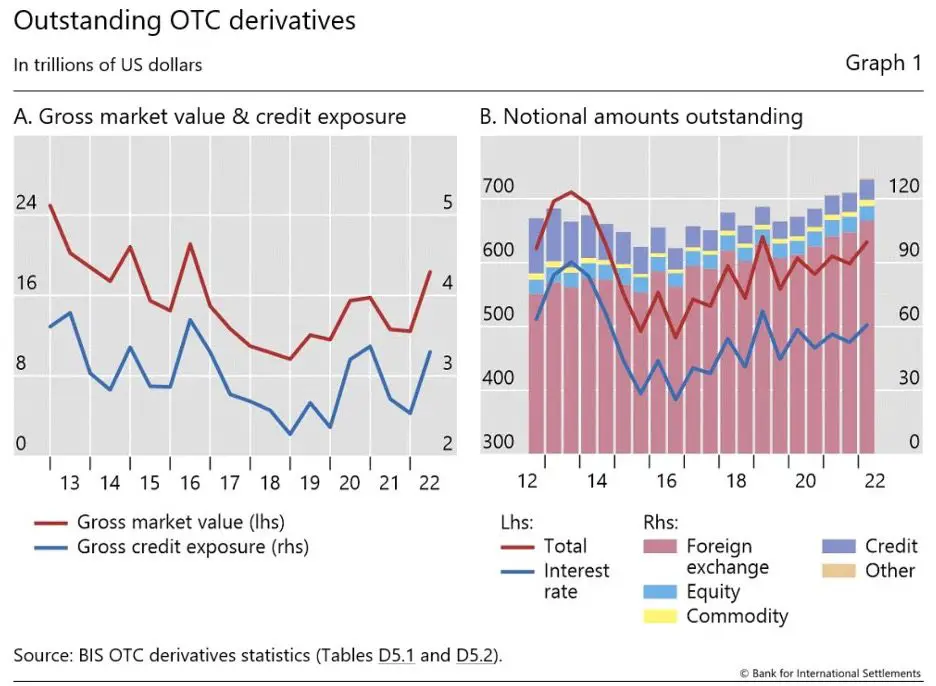

Source: BIS OTC derivatives statistics

The derivatives market, often measured in trillions or even quadrillions of dollars, is a colossal pillar in finance. As of June 2021, the gross value of derivative contracts reached a staggering $12.6 trillion, according to Bis.org. In recent years, the value of this market has grown in leaps and bounds.

With the digital transformation era sweeping through the financial industry, derivatives and Contract for Difference (CFD) trading players find themselves navigating a tremendous sea of offerings, seeking digital solutions that align with their evolving needs. Every single tradable asset, from shares, forex, indices, commodities, bonds and digital options is available in CFD format.

This DIY guide delves into the dramatic impact of emerging technologies on the derivatives and CFD trading landscape. We examine how these innovations are reshaping the industry. From data analytics to blockchain technology, read on to discover how technology revolutionises derivatives and CFD trading. An ocean of options exists in the derivatives market – let’s explore further:

Derivatives and CFD Trading: Challenges and Industry Dynamics

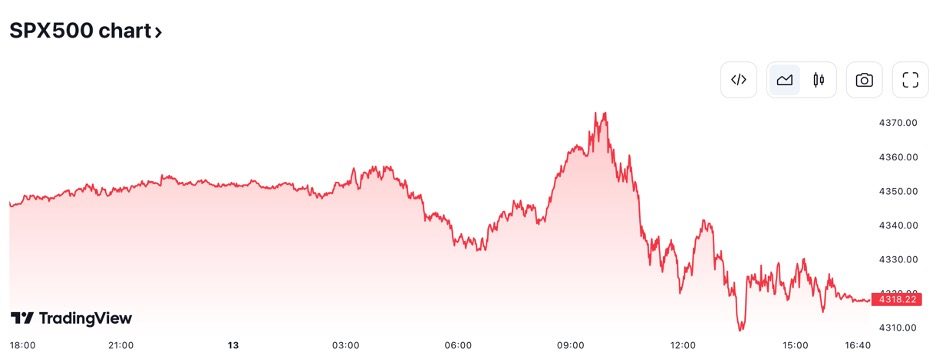

Source: TradingView S&P 500 Index

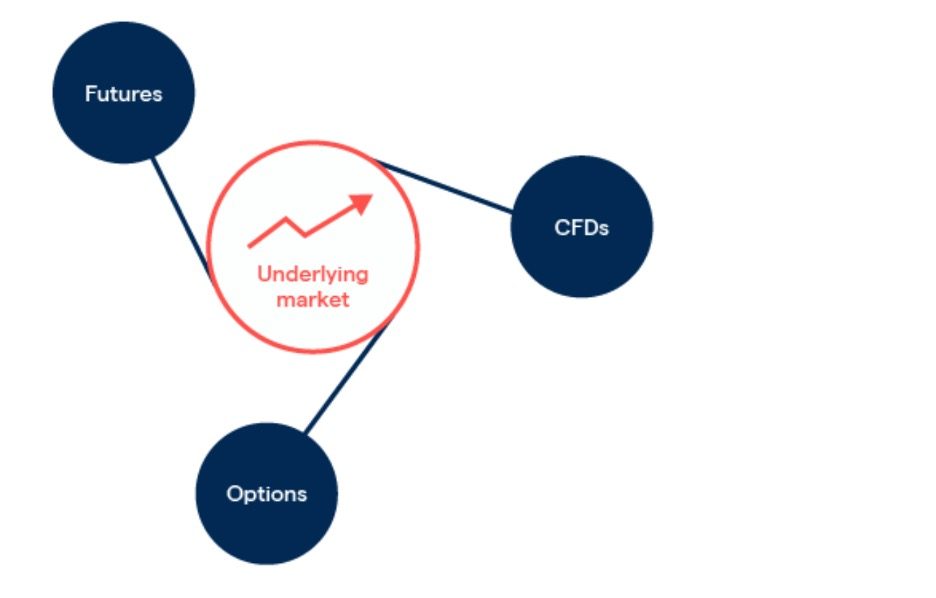

In finance, derivatives are financial contracts whose value derives from underlying assets. These assets can include futures, options, warrants, stocks, bonds, interest rates, and swaps. The value of derivatives fluctuates in response to changes in the underlying assets, making the derivatives market highly volatile and unpredictable. That means the price of derivatives is ‘derived’ from the price of the underlying financial instruments.

Conversely, CFDs are a specific type of derivative that allows traders to speculate on the price movements of underlying assets without owning them. CFD trading is known for its flexibility and leverage, enabling traders to access various markets. With CFDs, traders track price movements tied to the assets. Call and put options exist with CFDs. Traders use leverage to amplify trade sizes, while minimizing upfront outlays. However, there are substantial risk elements to the downside.

One of the significant challenges in this landscape is navigating the complex web of regulations that affect trading ecosystems. Market participants now prioritise post-trade processes over back-office operations. Importantly, these markets rely on automation. This is key to streamlining transaction approvals, record-keeping, and securities and payment transfers. The best trading platforms facilitate use of these algorithmic systems.

Recent European regulations have compelled derivatives and CFD trading parties to reconfigure their database structures to facilitate seamless reporting of additional data, such as the specific trading model used in each transaction. The rules thereof are ensconced in financial laws with the respective authoritative bodies.

Technologies Transforming Derivatives and CFD Trading

Source: IG.com Derivatives

Now, let’s take a look at the technologies driving derivatives and CFD trading transformation.

Data Analytics

- Modern derivative and CFD trading hinges on data processing, aggregation, and analytics. The challenge is no longer automated reporting but ensuring data quality and diversity.

- Traders employ AI (Artificial intelligence) and analytics to extract insights from vast datasets, enhancing strategic decision-making. Natural Language Processing (NLP) and machine learning assist in mining valuable insights from text and documents.

- Leading platforms enable investors to aggregate, process, and analyse massive data for market surveillance, fraud detection, and strategic decision-making.

Data Visualisation

- Emerging tech solutions focus on data visualisation, simplifying market data for buyers and sellers in derivatives and CFD markets. Complex financial data is translated into visual maps and dashboards, aiding understanding.

- Virtual reality is used in data visualisation, offering immersive experiences that help analysts and traders quickly identify anomalies and make informed decisions.

Blockchain

- Blockchain is still evolving and harnessed for buying and selling derivatives and CFDs. It promises enhanced security through tamper-resistant trade data storage. This is the latest virtual arena for CFD and derivatives trading.

- Industry associations like the International Swaps and Derivatives Association are exploring blockchain for cost reduction and increased efficiency in documentation and automated execution.

RegTech

- Regulatory Technology (RegTech) tools assist traders in meeting compliance requirements in a highly regulated derivatives and CFD trading market. These tools track compliance processes and communication on trading desks, ensuring regulatory adherence. RegTech is a hot new arena that holds plenty of promise.

Applications for mobile trading will keep developing, bringing more functionality and seamless integration with new technology. Trading systems will improve use, intuitiveness, and customisation, providing traders with a tailored and practical trading experience.

Though these technological developments have many advantages, it’s crucial to remember that they also present specific difficulties. Addressing concerns about data privacy, cybersecurity, and regulatory compliance is essential as technology develops.

Tech development will ultimately lead to a bright and vibrant future for CFD trading. Algorithmic trading, artificial intelligence, blockchain, mobile apps, and improved trading platforms are revolutionising how traders conduct business by enhancing productivity, accessibility, security, and customisation.

The Future Unveiled

As we move forward into this ever-evolving landscape, it becomes clear that the future of derivatives and CFD trading holds boundless potential. Algorithmic trading, artificial intelligence, blockchain, mobile applications, and enhanced trading platforms are at the forefront of this transformation, propelling us towards a new era of efficiency, accessibility, security, and customisation.

But with dramatic progress comes great responsibility. We must address the challenges of data privacy, cybersecurity, and regulatory compliance as technology continues its relentless march forward. Adaptation, skill enhancement, and vigilance are our allies in this dynamic environment.

In this ongoing journey, technology guides us towards a brighter and more vibrant future for CFD trading. The fusion of innovation and tradition will define our success, offering traders the tools to thrive in an ever-changing market landscape.

With these major advancements paving the way, derivatives and CFD trading are poised to undergo a paradigm shift. Traders can position themselves for success by embracing these technical innovations and staying connected to market trends.