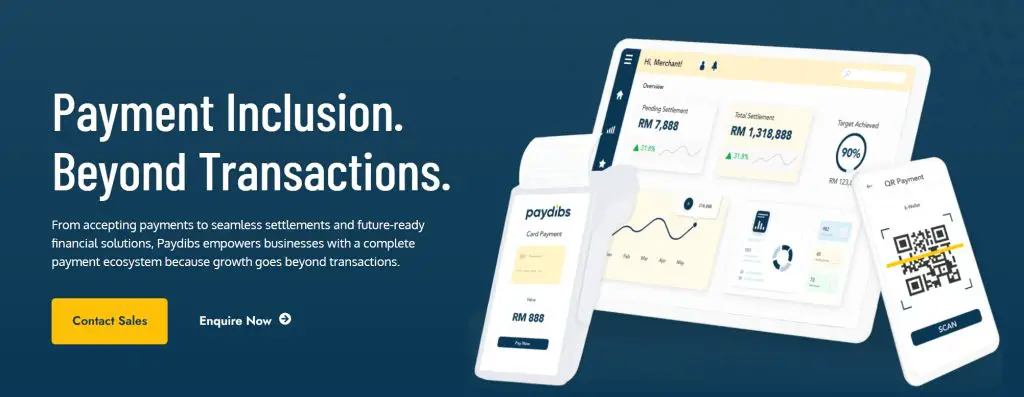

Paydibs has announced its refreshed launch in Malaysia despite it being in the local digital payments scene for quite a while.

With a new comeback carrying an interesting refreshed identity and a game plan that’s clearly geared for the future, they are ready to step into the spotlight with a new leadership lineup made up of veterans in payments, stored value, and digital lending – all backed by a team that’s no stranger to fintech.

With this reboot, Paydibs is positioning itself as a modern, growth-centric player in an increasingly crowded space with over 60 providers. They’ve updated their tech stack, built direct links to national payment rails, and streamlined the user experience for merchants, putting themselves in a strong position to scale.

One of the key highlights of their relaunch is a new all-in-one payment terminal that supports both QR and card payments, designed specifically to make life easier for retailers, F&B outlets, and service-based businesses. On top of that, they’re rolling out faster settlement options like T+1 and even same-day T+0 payouts (with terms, of course), giving SMEs quicker access to their money while still keeping risk under control.

They’re also getting into embedded financing, where businesses can qualify for working capital based on real-time transaction data, making it easier and faster to get loans without the traditional red tape. And through a partnership with MCash, their new terminals can now offer bill payment and mobile reload services, effectively turning each unit into a mini revenue generator for merchants.

What’s more, Paydibs now connects directly to national payment rails and acquiring banks, which means transactions can be processed faster and more efficiently thanks to true straight-through processing. All of this ties into their new mission of “Payment Inclusion. Beyond Transactions.”, summed up by their threefold focus: Pay In. Payout. Finance.

On the national level, they’ve also been appointed as a Digital Partner under the BSN MSME Digital Grant (MSME MADANI), showing they’re recognized as a serious player in driving digital adoption and financial access for underserved businesses.

Bottom line: Paydibs is no longer just another payments provider – it’s reshaping itself into a full-fledged digital partner for modern commerce. As businesses look for smarter, more responsive solutions, Paydibs is ready to prove that payments can be more than just transactions – they can be the engine for growth, better customer engagement, and broader financial inclusion.