From closing off exports of NVIDIA’s H100 to H800 down to recent H20, the US government continues to tighten restrictions on giving up NVIDIA’s AI chips to other countries around the world, especially towards its rival superpower China.

But they have continued to struggle, not only in stopping them from getting actual units, such as one loaded Chinese merchant obtaining multiples of H200s hosted within a SuperMicro enclosure, but also in slowing down efficiency improvement and cost of usage spearheaded by the likes of DeepSeek.

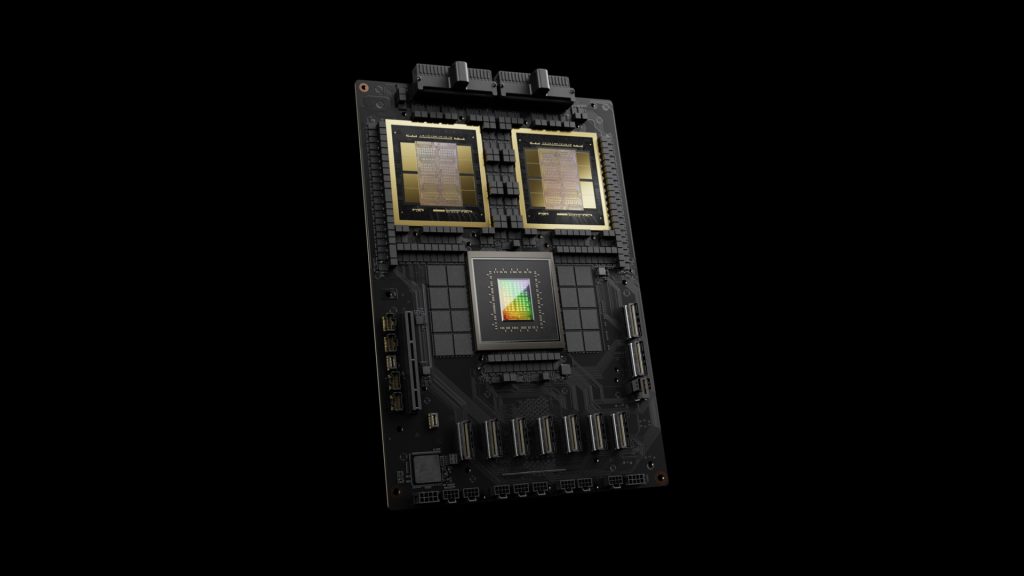

To stop the precious NVIDIA chips from “leaking” into banned regions via trade loopholes and grey market channels. Now, U.S. lawmakers are weighing a more aggressive approach: embedding “kill switches” in AI accelerators to enforce export compliance.

Proposed by an Illinois-based Democrat named Bill Foster, who has an expert background in particle physics and chip design, he’s talking about a possibility that requires AI chip manufacturers to integrate tracking mechanisms directly into their hardware. According to Foster, the underlying technology for such enforcement already exists and could provide U.S. authorities with both visibility and control, and in a worst-case scenario, disabling a chip if it ends up in unauthorized hands.

While the proposal signals a shift toward hardware-level enforcement as national security concerns mount over China’s AI capabilities, Team Green, on the other hand, has stated that it has no way to monitor or prevent unauthorized re-exports, pointing to persistent loopholes in global trade. The potential introduction of a kill switch, once unthinkable, is now being seriously discussed as policymakers push for more effective safeguards.

Despite details of the proposal not covering who is going to control the “kill switch” at the moment, whether it is NVIDIA or the U.S government, such discussion only further proves the point of AI hardware becoming a strategic lever in the growing intersection of technology and geopolitics.

Ironically, such hardline measures continue to incentivize China to accelerate the development of its homegrown AI infrastructure. With rising uncertainty around the reliability of U.S. chips, Chinese companies are increasingly investing in local AI silicon and software frameworks. Recently, Huawei has started to test its Ascend AI 910D chip to rival NVIDIA Blackwell and perhaps the upcoming Rubin family of offerings, with early tests showing contestable results despite being worse in efficiency. Not only that, they planned to build scalable pods that can match performance one to go through multiple deployments, essentially beating the race with sheer amount of hardware.

On the software part, things like Alibaba’s Qwen series LLMs for industrial application and many more in-house AI features created by the likes of smartphone brands and whatnot, will probably lead to a better vertically integrated AI systems in China—designed from the ground up for domestic needs, and potentially harder to counter with traditional export controls.